how to pay indiana state withholding tax

Pay my tax bill in installments. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT.

Web Your browser appears to have cookies disabled.

. Web Any business meeting these qualifications must register with the Department of Revenue. There is a service fee. In addition the employer should look at Departmental Notice 1 that details the withholding rates for each of Indianas 92 counties.

Web If you are required to withhold federal taxes then you must also withhold Indiana state and county taxes. Underpayment of Indiana Withholding Filing. You may find them at wwwingovdorlegal-resourcestax-libraryinformation-bulletinsincome-tax-information-bulletins.

Indiana counties local tax rates range from 050 to 290. Enter your Indiana county of residence and county of principal employment as of January 1 of the current year. Web Pay Taxes Electronically.

For the feds. After your business is registered in Indiana you will begin paying state and local income taxes on any profits earned in Indiana and sales tax on any tangible property sold or shipped from the state. Web To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. Indiana repealed Utility Services Use and Utility Receipts taxes effective July 1 2022.

Web Taxes should be withheld from a taxpayers paychecks throughout the year at a rate equal to the total of the state and county rate but youll still need to file a state income tax return. Register and file this tax online via INTIME. If you do not file a return and pay the proper amount of tax you will face criminal prosecution for fraud or tax evasion.

Income Tax Information Bulletins which may be of assistance with withholding tax questions are numbers 16 32 33 and 52. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees fuel taxes wireless prepaid fees food and beverage taxes and county innkeepers.

More information is available in the Electronic Payment Guide. Web What are the payroll tax filing requirements. There are income restrictions if you or your spouse has a retirement plan through your employer.

Know when I will receive my tax refund. Some of the expenses and types of. Once registered with the Indiana Department of Revenue they will issue the WH-1s and determine the filing status.

Register and file this tax online via INTIME. Web This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. Web Indiana businesses have to pay taxes at the state and federal levels.

Web Find Indiana tax forms. Have more time to file my taxes and I think I will owe the Department. For single or head of household status the limit is 56000 for a full 5000 deduction and 66000 for a partial deduction.

Credit card payments may be made through the Ohio Business Gateway OBG or over the Internet by visiting the ACI Payments Inc. Web Repeal of Utility Services Use Tax and Utility Receipts Tax. Cookies are required to use this site.

Form WH-1 Withholding Tax Voucher for EFT Early Filer Early Filer Monthly Annual filers. Web To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government. Claim a gambling loss on my Indiana return.

Accessing from Employee Center. Corporations must pay the. Withholding payments must be made to DOR by the due dates or penalties and interest will be assessed.

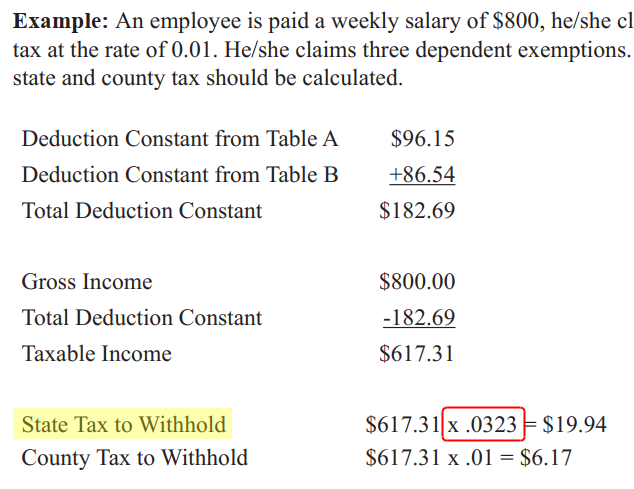

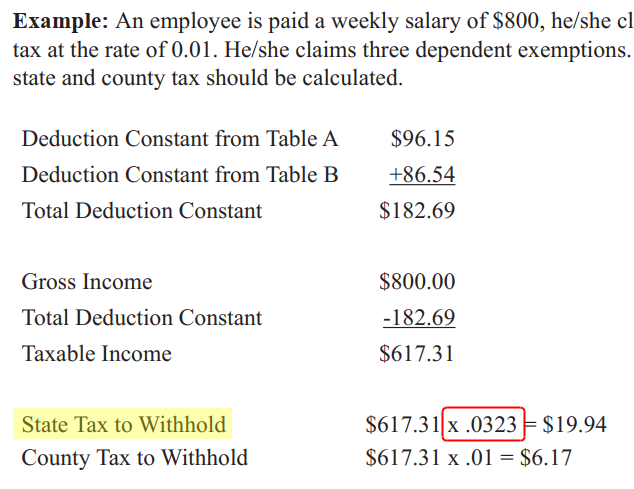

Web State Tax to Withhold 61731 x 0323 1994 County Tax to Withhold 61731 x 01 617 Note. Web Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. If your status is married filing jointly you can earn 89000 for the full deduction or 109000 for.

There is no standard deduction in Indiana but taxpayers may still claim itemized deductions on their Indiana state income tax return. Take the renters deduction. Forms required to be filed for Indiana payroll are.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Print or type your full name Social Security number or ITIN and home address. Register and file this tax online via INTIME.

Web You can use your American Express DiscoverNOVUS MasterCard or Visa credit card to pay your withholding tax liability. Although these laws are repealed you must still file any past-due returns and pay taxes due to DOR. This registration can be completed in INBiz.

In addition the employer should look at Departmental Notice 1 that details the withholding rates for each of Indianas 92 counties. File online using IN. Indiana Withholding Tax Voucher.

Annual Withholding Tax Form.

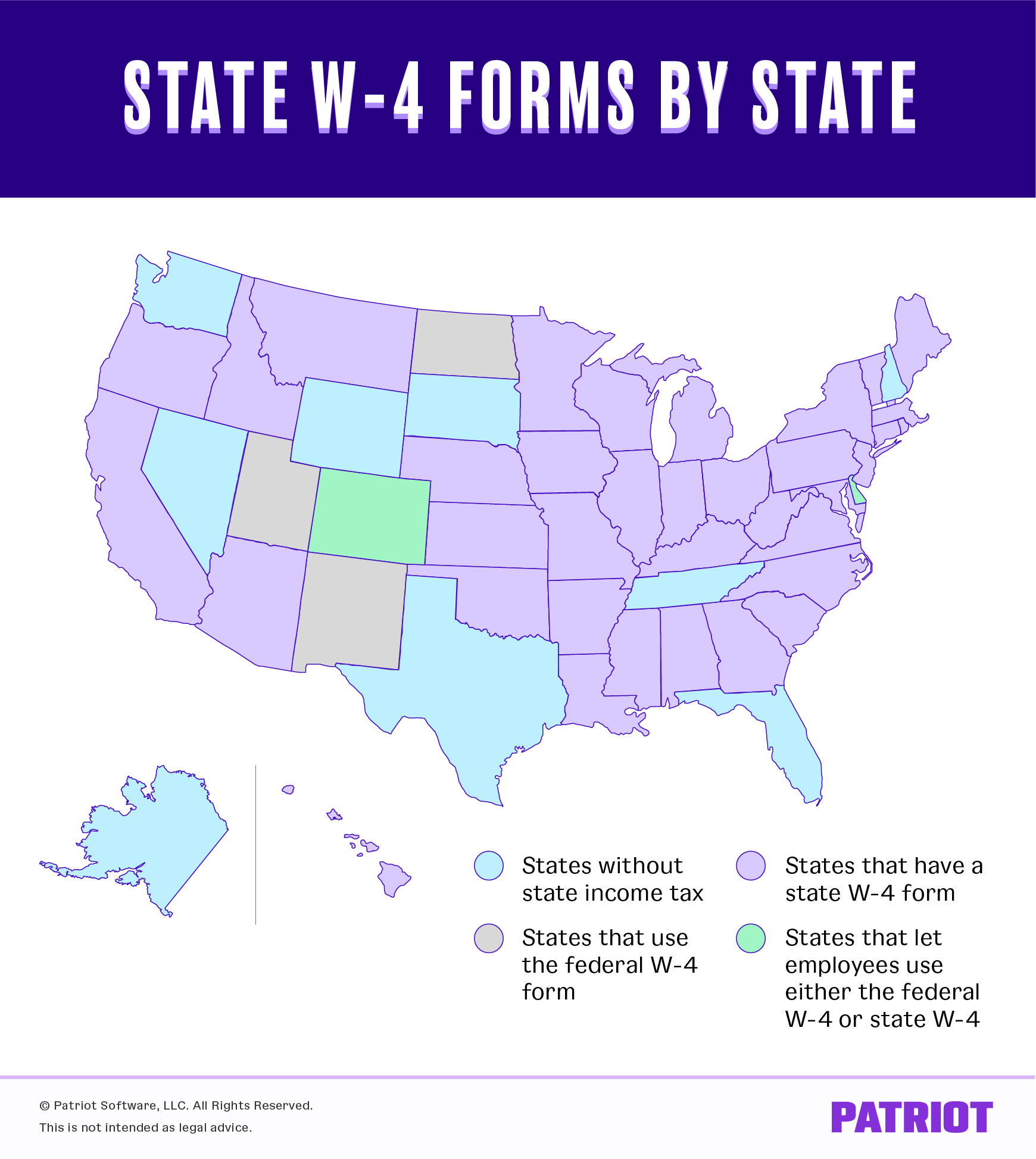

State W 4 Form Detailed Withholding Forms By State Chart

Should You Move To A State With No Income Tax Forbes Advisor

State W 4 Form Detailed Withholding Forms By State Chart

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog

Can I Print My Own Payroll Checks On Blank Check Stock Welcome To 1099 Etc Com Payroll Checks Printing Software Writing Software

State Income Tax Rates Highest Lowest 2021 Changes

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Purdue University Degree Pu Diploma Buy Fake Purdue University Degree Buy Fake Pu Diploma University Degree Free Certificate Templates Usa University

Solved Indiana Withholding Setup In Quickbooks Payroll

State W 4 Form Detailed Withholding Forms By State Chart

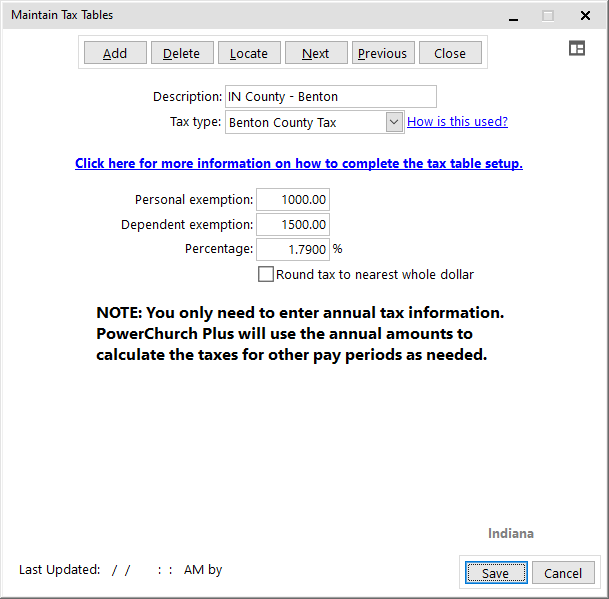

Church Management Software For Today S Growing Churches Powerchurch Software

State Corporate Income Tax Rates And Brackets Tax Foundation

Solved Indiana Withholding Setup In Quickbooks Payroll

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

Powerchurch Software Church Management Software For Today S Growing Churches